March 22, 2022

Written Statement of Kevin Bruce, Executive Director Gulf Energy Alliance

Ranking Member Westerman, Ranking Member McMorris Rodgers, and Ranking Member Graves, thank you for the opportunity to participate in today’s forum regarding actions Congress and the Biden Administration can take to maximize immediate and long—term energy production to secure our country, support our allies, and help American families.

My name is Kevin Bruce and I am the Executive Director of the Gulf Energy Alliance, a coalition of leading independent offshore oil and natural gas producers whose operations are primarily focused in the U.S. Gulf of Mexico. Our mission is to support policies and regulations that encourage investment, innovation, and job creation for the offshore industry. Independent offshore producers are not the household names with which you may be familiar, and we have distinctly different business models than the major oil and gas companies. Collectively, however, we contribute significantly to U.S. offshore oil and natural gas production. In 2019, independent oil and gas companies produced approximately 47% of the total Outer Continental Shelf oil and natural gas production and provided 53% of the total offshore revenues paid to the U.S. Treasury. With a strong focus on the safety of our employees and contractors, offshore producers support hundreds of thousands of jobs across a vast and nationwide supply chain.

I also serve as the Vice President of Government Affairs at Arena Offshore, LP (Arena), which is an active member of the Gulf Energy Alliance. Arena is an employee—owned independent exploration and production company with an exclusive focus on offshore oil and natural gas development in the U.S. Gulf of Mexico. Over the past 22 years, Arena has grown to become one of the largest private offshore oil and natural gas companies, investing over $4 billion of capital in the Gulf, paying over $1.2 billion in royalties to the federal government, and has decommissioned over 300 wells, 45 platforms, and many other structures. Despite a prolonged period of low commodity prices and extreme volatility in capital markets relating largely to the COVID—19 pandemic, we have expanded our commitment to the U.S. Gulf of Mexico by investing in affiliated companies that provide drilling rigs, pipelines, and environmental remediation services to the industry. These investments were made to ensure safer operations, mitigate against pollution risks, and to ensure the safe and timely removal of idle wells, pipelines, and platforms in the Gulf.

The current challenges in energy markets began long before Russia invaded Ukraine three weeks ago. According to data from the Energy Information Administration, the price of gasoline at the pump has increased every month during the Biden Administration. On Inauguration Day in 2021, the price of WTI was $53.40 per barrel.1 On February 24, the day Russia invaded Ukraine, the price of WTI was $99.66 — an 87% increase.2 The increase caused by the Russian invasion only compounded the dramatically higher oil prices over the past year and cannot all be blamed on Vladimir Putin.

Meeting the demand for reliable and affordable energy while at the same time supporting the transition to a lower carbon future is the challenge of our time. In a time of geopolitical upheaval and rising energy prices, the importance of American energy security — as well as that of our allies — has never been in sharper focus. As the Russian invasion of Ukraine has made clear, not all barrels of oil are created equal. The question we must answer is whether we will meet demand for fossil fuels with “good barrels” or “bad barrels.”3 The good news is that the best barrels in the world are produced right here in the U.S.

I. The Gulf of Mexico is a National Strategic Asset that Should be Utilized to Bolster Domestic Oil and Gas Production

Under every scenario, worldwide consumption of all forms of energy — including oil and natural gas — are projected to increase for the foreseeable future.4 If we are serious about confronting geopolitical threats and reducing global emissions in a way that will

- Meet global demand over the near, medium, and longer terms,

- Protect and advance national security,

- Ensure energy affordability,

- Provide reliable, on—demand energy, and,

- Advance emissions reduction efforts

we cannot limit oil supply from “good” areas, which will have no impact on global demand and instead shift production to bad areas and empower our adversaries.5 Instead, to meet domestic and global energy demand for fossil fuels, we should promote production from those areas where there are strong environmental regulations, lower emissions, and from places with stable, all ied governments.

Oil and natural gas produced in the Gulf of Mexico is a lower carbon alternative to oil produced by foreign, higher emitting producers like Russia, Venezuela, and Iran, and the benefits that flow from U.S. Gulf of Mexico production are vast. Beyond the obvious national security and energy affordability benefits, oil production in the Gulf of Mexico has among the lowest greenhouse gas emissions intensity in the world, with approximately half the carbon intensity of other producing regions while also outperforming the rest of the world in methane emissions .6 This will only continue to improve as the industry uses existing infrastructure to produce hydrocarbons in increasingly efficient ways.

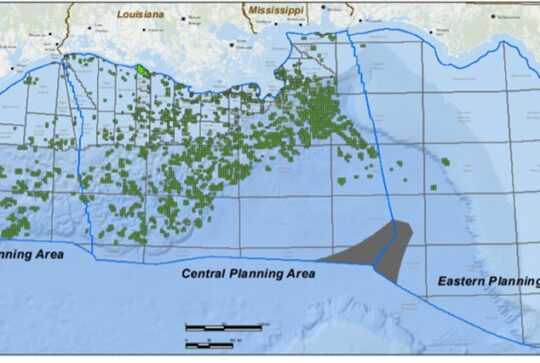

Gulf producers continue to produce a massive amount of energy with a small — and shrinking — physical footprint. In December 2016, for instance, there were 873 producing leases in the Gulf.7 As of this month, the number of producing leases has fallen to 479.8 Despite the fact that the number of producing leases has been cut in half, production has stayed flat at around 1.73 million barrels of oil per day. Until recently, however, the Gulf was on a trajectory to produce 2.5 million barrels per day.9

The fact is that finding new oil and gas is a highly prospective venture, and lease sales are the lifeblood of production in the U.S. Gulf of Mexico. Whether companies are looking for new discoveries or want to incorporate new lease blocks into existing projects, offshore producers require acreage. To get acreage, we need regularly scheduled lease sales. Last year was the first time since 1965 that the government did not award a federal lease, and it appears that 2022 will be the first time since 1958 that the federal government will not hold a lease sale.10 In the face of rising energy prices, widespread inflation, and geopolitical uncertainty, it is imperative that we encourage, rather than restrain, oil and natural gas production in the U.S. Gulf of Mexico.

II. Current Policies are Impeding Domestic Production

On January 20, 2021, Executive Order 14008 — “Tackling the Climate Crisis at Home and Abroad” – “temporarily” paused new oil and natural gas leases in offshore waters pending completion of a review and reconsideration of the federal offshore leasing program. This “pause” had an immediate chilling effect on offshore oil and natural gas production and capital markets as investors were forced to seriously rethink their long—term commitment to the U.S. Gulf of Mexico. Since then, the situation has only deteriorated. The “temporary pause” has become a de facto ban on federal lease sales, with no end currently in sight.

High energy prices can destroy the economy. Every recession since 1970 was preceded by high oil prices. And as we are witnessing first—hand right now, high oil prices are a significant driver of inflation and strains the U.S. supply chain by driving up shipping and other transportation and manufacturing costs. If the Biden administration is serious about bolstering U.S. domestic supply chains, it would also look at ways the government can partner with domestic oil and natural gas producers to increase production and lower costs.

Finally, what seems to be lost in these policies is the negative budgetary impacts on the Land and Water Conservation Fund and the Great America Outdoors Act, both of which rely on revenues from offshore oil and gas production and fund thousands of conservation and wildlife projects, state and local recreational opportunities across the country, and are reducing the maintenance backlog in our national parks. We cannot have robust conservation funding without a robust offshore leasing program.

III. Actions that Congress and the Biden Administration Should Take Immediately to Increase Offshore Production in the Gulf of Mexico

Instead of looking to Iran and Venezuela as stop—gap solutions to increasing global supply, we should be doing everything possible to bolster domestic production. Have we not learned anything from the Russian invasion of Ukraine? As Western Europe has learned, when we depend on foreign resources for domestic consumption, we are at the mercy of their political regimes.

Industry knows we can be part of a real solution. Beginning in 2020, the U.S. became a net exporter of oil and natural gas. Now, however, the EIA projects that the U.S. will become a net importer of oil in the coming years, importing oil from bad actors around the world. There are no solutions to the current energy challenges which do not include increasing production domestically, both onshore and offshore. And this presents a great opportunity for the Administration and Congress to implement policy changes which would provide important relief to Americans and our allies.

1. Overturn the Current Moratorium on Offshore Leases. The current moratorium on offshore leases and permits is not only impeding current production, but also stifling investments that are critical to ensuring future production. Rep. William Timmons (R – SC) said it best during the March 8, 2022, House Financial Services Committee hearing on inflation, “When government goes to war with industries, it discourages investment and subsequent capacity.” Americans desperately need access to domestically produced oil and gas. The Administration and Congress should use this as an opportunity to partner with industry to implement real and lasting solutions.

2. Release a New Five—Year Leasing Plan and Hold Additional Lease Sales. To hold additional lease sales, the Department of Interior must have in place a five—year lease plan that outlines the number and timing of lease sales. The current five—year lease plan expires on June 30, 2022. Without another five—year plan, no further lease sales can legally take place. Federal offshore waters comprise 1.7 billion acres, of which only 12 million acres are currently under lease, which represents less than 1% of available offshore acreage. The Biden Administration should release a new five—year plan as soon as possible, notice new offshore lease sales, and expedite permitting for new leases.

3. Expedite the NEPA Review Process for Domestically Produced Offshore Oil. The current environmental review process can take up to two years to complete. While it is important to recognize and mitigate impacts of offshore development on the environment, this process prevents oil and gas produced in the most environmentally friendly manner from reaching the U.S. market, drives up costs for Americans, and results in costly litigation, which has a lasting impact on capital markets. By streamlining the environmental review process under NEPA, investors and industry can be readily available to provide affordable energy to Americans.

4. Replace Russian Gas with Domestically Produced LNG. Turning to partners like Iran and Venezuela will not fix our current problem. It will only shift it to a new foreign actor. Instead, we should rely on domestically produced LNG to provide our allies with affordable natural gas. Europe is dependent upon Russian gas and American LNG is the obvious replacement for gas that is currently piped into Germany and other European countries.

Thank you for the opportunity to participate in today’s forum. I look forward to working with your Committees to discuss how oil and natural gas production in the U.S. Gulf of Mexico can bolster U.S. energy independence and national security while also providing Americans with access to reliable and affordable energy.

1 U.S. Energy Information Administration, “Short – Term Energy Outlook” (March 2022),

https://view.officeapps.live.com/op/view.aspx?src=https%3A%2F%2Fwww.eia.gov%2Foutlooks%2Fsteo%2Frealprices%2Freal_prices.xlsx &w d Origin=BROWSELINK

2 Ibid.

3 Murti, Arjun. “We Need More Good Barrels and Fewer Bad Barrels.” Super – Spiked , 12 Mar. 2022,

https://arjunmurti.substack.com/p/we – need – more – good – barrels – and – fewer?s=r

4 EIA projects nearly 50% increase in world energy usage by 2050, led by growth in Asia, U.S. Energy Information Administration (EIA) (Sept. 24, 2019),

https://www.eia.gov/todayinenergy/detail.php?id=41433

5 Murti (n 3).

6 “Carbon Emissions performance in US GOM: a low emitter in the crossfire,” Wood Mackenzie Insight (Feb. 2021), p. 3; see also “Year 2017 Emissions Inventory Study”, OCS Study BOEM 2019 – 072 (October 2019) https://espis.boem.gov/final%20reports/BOEM_2019-072.pdf.

7 Bureau of Ocean Energy Management; U.S. Energy Information Administration.

8 Ibid.

9 Energy & Industrial Advisory Partners. The Economic Impacts of the Gulf of Mexico Oil and Natural Gas Industry, 2021.

10 Bureau of Ocean Energy Management, All Lease Offerings,

https://www.boem.gov/sites/default/files/documents/aboutboem/Table%201%20SwilerTable%2024FEB2021.pdf