May 13, 2021

Written Testimony of Mike Minarovic, Chief Executive Officer of Arena Energy

Chairman Manchin, Ranking Member Barrasso, and Members and staff of the Senate Committee on Energy and Natural Resources, thank you for the opportunity to testify this morning. My name is Mike Minarovic and I am the Co‐Founder, President and CEO of Arena Energy, an employee‐owned independent exploration and production company with an exclusive focus on offshore oil and natural gas development in the U.S. Gulf of Mexico.

Over the past 22 years, Arena has grown into one of the largest private offshore oil and natural gas companies, having invested over $4 billion of capital in the Gulf of Mexico, paid over $1 .1 billion in royalties to the government, and decommissioned over 300 wells and 45 platforms and other structures. We conduct our operations with an intense focus on the safety of our employees and contractors. We have produced significant volumes of both oil and natural gas in an environmentally responsible manner, especially relative to foreign producers, many of whom do not share our focus on environmental stewardship. Our operations support thousands of jobs along the Gulf Coast and throughout the country.

Despite a prolonged period of low commodity prices and extreme volatility in capital markets relating largely to the pandemic, we have expanded our commitment to the U.S. Gulf of Mexico by investing in affiliated companies which provide drilling rigs, pipelines, and environmental remediation services to the industry. These investments were made to ensure safer operations, mitigate against pollution risks, and to decommission wells, pipelines, and platforms in the Gulf. Most recently, we have dedicated resources to research into repurposing existing oil and gas platforms to facilitate offshore renewable energy and carbon sequestration projects.

I also speak today on behalf of the Gulf Energy Alliance, a coalition of leading independent offshore producers whose operations, like Arena’s, are primarily focused in the Gulf of Mexico. Independent offshore producers are not the household names with which you might be familiar, and we have distinctly different business models than the major oil and gas companies. Collectively, however, we are the backbone of the offshore oil and gas industry in the U.S. In 2019, independent oil and gas companies collectively produced approximately 47% of the total Outer Continental Shelf oil and natural gas production and provided 53% of the total offshore revenues paid to the U.S. Treasury.

Why are Arena and other offshore producers so committed to the U.S. Gulf of Mexico?

- The U.S. Gulf of Mexico is a world‐class basin for oil and natural gas exploration and development due in large part to the historical and resounding success of the federal offshore leasing program.

- While the transition to a lower carbon future is inevitable and fully supported by the industry, global demand for oil and natural gas will continue for the foreseeable future.

- We believe—and science supports—that when it comes to climate change, oil and natural gas produced in the U.S. Gulf of Mexico is among the most environmentally advantaged production in the world.

Climate change is a global issue. For many reasons, U.S. domestic production is among the best places in the world to produce the oil and natural gas that the U.S.—and the world—will still require. The U.S. Gulf of Mexico is the environmental crown jewel of domestic production. Ceding the advantages of U.S. domestic production will only ensure these resources are developed elsewhere—possibly to our geopolitical detriment, at an economic loss of royalties and jobs, and most certainly at a higher environmental cost.

I. The success of the federal offshore leasing program created and sustains an American strategic asset

The temporary “pause” on federal lease sales for public lands and federal waters announced in January 2021—recently extended until July 2021 at the earliest—has had an immediate chilling effect on offshore oil and natural gas producers and capital markets. Absent an end date, there is growing concern among offshore oil and gas stakeholders that the temporary “pause” will be extended indefinitely, in effect becoming a de facto permanent ban on federal offshore lease sales. I believe a further pause or ban on lease sales is misguided, because (1) it jeopardizes a significant strategic asset—namely, U.S. Gulf of Mexico energy production, and (2) that strategic asset is one of the least carbon‐intensive sources of oil and natural gas currently available.

Extending the temporary “pause” on lease sales jeopardizes this strategic asset—and the impacts are already here. The “pause” has forced capital providers to seriously rethink their long‐term commitment to the Gulf and has already impaired future production. The end result of an indefinite “pause” or outright ban on new leasing will be capital flight to other areas of the world where the oil and natural gas needed to meet demand will still be produced, but under much lower environmental standards. The Obama‐Biden Administration shared this view, concluding in a 2016 report by the Bureau of Ocean Energy Management (BOEM) that “[e]missions from substitutions are higher due to the exploration, development, production, and transportation of oil from international sources being more carbon intensive.”1

In fact, the U.S. still imports on average over six million barrels of crude every day.2 A recent Wood Mackenzie report shows that imports from the largest U.S. crude importers—including from Canada, Mexico, Colombia, Nigeria, Russia, and Iraq—have significantly higher emissions intensities than U.S. offshore production.3 This study did not include the additional emissions from the shipping and transport of imported barrels, which would have yielded an even higher emissions footprint. Regardless, these findings confirm the Obama‐Biden Administration’s acknowledgment that reducing or restraining U.S. offshore production will result in higher U.S. carbon dioxide and methane emissions as we are forced to import crude with higher emissions‐intensities to meet domestic demand.

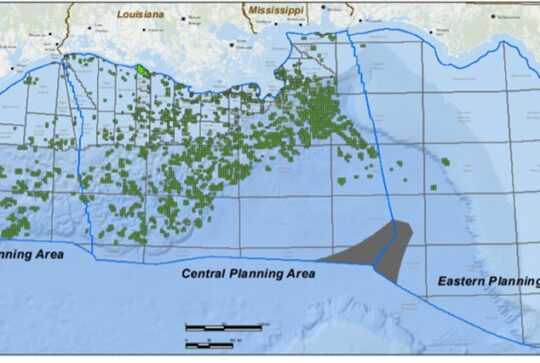

The leasing “pause” has been coupled with serious misconceptions that the offshore industry “stockpiles” leases and permits. U.S. federal waters comprise 1.7 billion acres, of which only 12 million acres are currently under lease—less than 1% of available federal offshore acreage.4 The “stockpiling” notion is unequivocally false under the Outer Continental Shelf Lands Act (OCSLA). Every offshore lease awarded under OCSLA forms a contract between the government and the lease holder which grants lessees the right, and imposes upon them the obligation, to evaluate the potential to produce commercial quantities of oil and natural gas.

Paying millions of dollars upfront to the government in a competitive bidding process to acquire a federal oil and gas lease is only the first step in a process which can often take up to a decade and cost hundreds of millions and even billions of dollars to bring a lease to production. This process involves years of due diligence and incremental investments of millions of dollars to conduct the rigorous scientific and economic analysis required to determine whether a lease contains commercial quantities of oil and natural gas. This includes reprocessing or shooting new seismic data, analyzing the seismic data to understand the geology and reservoir characteristics, running economic models, resizing reserve estimates, and seeking permit approvals. This process is highly regulated, and development plan approval involves at least fifteen major permits that must meet more than ninety federal regulations.

Meanwhile, as the geological analysis, technological and engineering assessments, and logistical considerations of a project progress, the federal government continues to benefit from annual rental payments. In addition to the receipt of bonus payments of more than $15 billion since 2007, the federal government has also received on average $180 million per year in annual rental payments—with a return of exactly zero dollars being earned by offshore producers on these primary term leases.5

If production does not commence on a lease or drilling operations are not currently in progress at the end of the primary term then, by law, the lease reverts to the government. This is a “use it or lose it” proposition; federal leases are no different in that respect from leases with private landowners. Every incentive in the federal offshore leasing program is aligned to bring a lease to production; the lease limitations under OCSLA preclude “stockpiling” leases.

In short, the federal offshore leasing program is a remarkably efficient market because of a regulatory system which has been—through successive Democrat and Republican Administrations since OCSLA’s enactment in 1953—predictable, consistent, and administered in accordance with statutory obligations under OCSLA. The success of this program has created and continues to sustain an American strategic asset as the world pursues a lower carbon future.

II. U.S. and global demand for oil and natural gas will not disappear overnight

Make no mistake: offshore oil and natural gas producers recognize and appreciate the risks of climate change, and we are committed to actively contributing to strategies and solutions in meeting this challenge. What seems to be lost in this discussion, however, is that any solution must balance current and future environmental, social, economic, and energy needs in the U.S. and abroad. Until U.S. and global demand are fully offset by less carbon‐intensive energy sources, we cannot reduce or restrain American production. Doing so will have no impact on domestic demand for oil and natural gas—it will simply force us to meet demand by importing foreign crude barrels with a higher emissions profile than those produced in the U.S. Gulf of Mexico.

The Energy Information Agency predicts we will need more forms of all energy in the future, projecting worldwide energy consumption to grow by 50% by 2050.6 World population is growing, and growth is greatest in regions of the world with higher rates of poverty. It is beyond refute that access to affordable energy is a fundamental catalyst for raising standards of living and improving quality of life. Oil and natural gas will remain a necessary and life‐sustaining fuel source for decades to come, even as we transition to less carbon‐intensive sources over the long‐term.

III. Oil and natural gas produced in the Gulf of Mexico is among the most environmentally advantaged production in the world

Not all barrels of oil are created equal. If we are serious about addressing climate change in a way that will

- Meet global demand in the short and medium terms

- Advance emissions reduction efforts

- Promote environmental justice, and,

- Protect U.S. energy and national security

then what is our best option? The answer is simple: While the world continues to develop non‐fossil fuel energy sources, and while we still have demand for fossil fuels, we should look to the least carbon‐intensive barrels to meet that demand.

The good news? The U.S. Gulf of Mexico has approximately half the carbon intensity of other producing regions and the industry continues to improve.7 From 2011 to 2017, according to BOEM, carbon emissions from U.S. Gulf operations decreased by approximately 60% even though oil production increased by over 35%.8 There are several factors explaining the lower carbon emissions of U.S. offshore production. Chief among them are the scale and inherently high level of investment and technology in U.S. offshore operations. Another is the extensive pipeline network which eliminates the need for shipping and trucking. Most offshore facilities produce vastly higher volumes from concentrated facilities, resulting in a much smaller footprint. The venting and flaring of natural gas produced offshore is tightly regulated, and subsea infrastructure and tiebacks are also important components in driving down emissions.

The U.S. Gulf of Mexico outperforms the rest of the world in methane emissions. The offshore industry has consistently achieved a ratio of less than 1.25% of flared/vented gas to produced gas, making the U.S. Gulf one of the best performing areas in the world.9 What explains this? Several factors, including that gas fugitive emission detection systems are widely used on offshore facilities, Vapor Recovery Units are utilized on many large processing platforms to capture methane, and many Gulf platforms utilize ultra‐ low or zero emission instrumentation to control processing equipment. The Gulf accounted for 15% of U.S. oil production in 2019 yet accounted for only 2.6% of nationwide natural gas venting and flaring emissions from energy production, and less than 1% of total nationwide methane emissions.10

From 2003 to 2019, U.S. offshore production contributed $107 billion to the U.S. Treasury through royalties, lease bonuses, and rents.11 These revenues support programs across the country which contribute to positive outcomes in environmental justice. The Land and Water Conservation Fund (LWCF) is funded almost entirely by offshore oil and gas production. The LWCF is a predominant source of funding for conservation programs across all fifty states, including programs such as the Outdoor Recreation Legacy Partnership Program, which provides funding to build or repair parks in economically distressed urban neighborhoods. The recent bipartisan enactment of the Great American Outdoors Act ensures that $900 million will be directed from offshore revenues to the LWCF annually, providing funding for national parks and communities across the country. Revenues from offshore production have also provided $5.4 billion for coastal restoration efforts across Gulf Coast states through state revenue‐sharing under the Gulf of Mexico Energy Security Act (GOMESA).

The U.S. offshore industry also contributes to local communities by creating numerous, high‐ paying jobs across a vast supply chain that reaches into almost every state in the country. Gulf Coast residents in adjacent states overwhelmingly support offshore oil and natural gas development.

Finally, the extensive infrastructure in place across the Gulf presents very promising opportunities for renewable energy and carbon sequestration which could support the transition to a lower carbon future. This includes offshore wind, storage of carbon captured from Gulf Coast industrial facilities in depleted shallow water reservoirs, geothermal and wave energy production, and other emergent technologies.

To conclude, I have been incredibly honored to have spent my more than thirty year career alongside a great workforce of American women and men in the oil and natural gas industry, where we take pride in producing the energy which has provided the foundation for U.S. economic growth and improved standards of living.

As we consider the best path forward toward a lower carbon future, we should ensure that we retain the distinct advantages of U.S. energy production, and specifically the strategic asset of the U.S. Gulf of Mexico oil and natural gas industry. If we are serious about addressing climate change in a way that will meet continuing U.S. demand, maintain affordable energy prices for American consumers, and protect energy and national security, oil and natural gas production in the U.S. Gulf of Mexico is part of the solution.

Thank you, again, for the opportunity to testify and I am happy to take any questions.

1 See “OCS Oil and Natural Gas: Potential Lifecycle Greenhouse Gas Emissions and Social Cost of Carbon,” Bureau of Ocean Energy Management, Department of Interior (November 2016) p. 36,

https://www.boem.gov/sites/default/files/oil‐and‐gas‐energy‐program/Leasing/Five‐Year‐Program/2017‐

2 “Oil and petroleum products: Oil imports and exports,” U.S. Energy Information Administration,

https://www.eia.gov/energyexplained/oil‐and‐petroleum‐products/imports‐and‐exports.php.

3 “Carbon Emissions performance in US GOM: a low emitter in the crossfire,” Wood Mackenzie Insight (Feb. 2021),p.3.

4 Statement of Katherine S. MacGregor, Acting Assistant Secretary of Land and Minerals Management, U.S. Department of Interior (U.S. House Subcommittee on Energy and Mineral Resources)(July 12, 2017), https://www.doi.gov/ocl/ocs‐oilgas‐development; “Combined Leasing Report,” Bureau of Ocean Energy Management(Feb. 1, 2021),

https://www.boem.gov/sites/default/files/documents/about‐boem/Lease%20stats%202‐1‐21.pdf.

5 See Office of Natural Resources Revenue historical data: https://www.onrr.gov/.

6 Capuano, Dr. Linda, “U.S. Energy Information Administration’s International Energy Outlook 2020,”Center for Strategic and International Studies, Washington, DC (Oct. 14, 2020) p. 36, https://www.eia.gov/outlooks/ieo/pdf/ieo2020.pdf.

7 See note 3 on p.2

8 See “Year 2017 Emissions Inventory Study”, OCS Study BOEM 2019‐072 (October 2019)

https://espis.boem.gov/final%20reports/BOEM_2019‐072.pdf.

9 See “Leaving better than we found it BSEE Director looks back on his tenure” (Offshore Magazine)(February 1, 2021) https://www.offshore‐mag.com/regional‐reports/us‐gulf‐of‐mexico/article/14196566/leaving‐it‐better‐than‐we‐found‐it‐bsee‐director‐looks‐back‐on‐his‐tenure.

10 Id.

11 See Office of Natural Resources Revenue historical data: https://www.onrr.gov/.